Analysis

6/26/23

7 min read

2023 Dynasty Fantasy Football: Undervalued Tight Ends

The tight end market often seems uninteresting because they score less than most positions. So finding undervalued tight ends in dynasty leagues became an interesting exercise because even the most exciting prospects and options don't seem to meet expectations. They might have a few spike weeks, but they're typically not the first, second or sometimes third option in their team's passing game.

During the past five seasons, 15 tight ends averaged 15 points per reception per game (PPR/G), with Travis Kelce and George Kittle accounting for eight of those instances. When we extend that to 12 PPR/G, the list grows to 30 and to 52 for 10 PPR/G. In the last five seasons, 93 receivers have averaged 15 PPR/G. Unsurprisingly, receivers dominate in PPR, so the list of running backs meeting the 15 PPR threshold falls to 68.

Since 2018, 15 tight ends averaged 10 PPR/G in their first three seasons. Kittle, Mark Andrews, T.J. Hockenson and Evan Engram accounted for eight of the 15 instances. It's hard to wait beyond Year 3 for a tight end to break out, so we used the first three seasons as a threshold. Like past dynasty articles, we'll compare Ian Miller’s dynasty positional rankings and KeepTradeCut's (KTC) rankings to the prevailing market sentiments to identify three potential undervalued tight ends.

Undervalued Dynasty Tight Ends

Pat Freiermuth, Pittsburgh Steelers

Pat Freiermuth, Pittsburgh Steelers

Miller's TE5 vs. KTC TE8

We'll kick it off with Pat Freiermuth as one of the undervalued tight ends after examining a Pittsburgh Steelers' running back and wide receiver in the previous parts of this series.

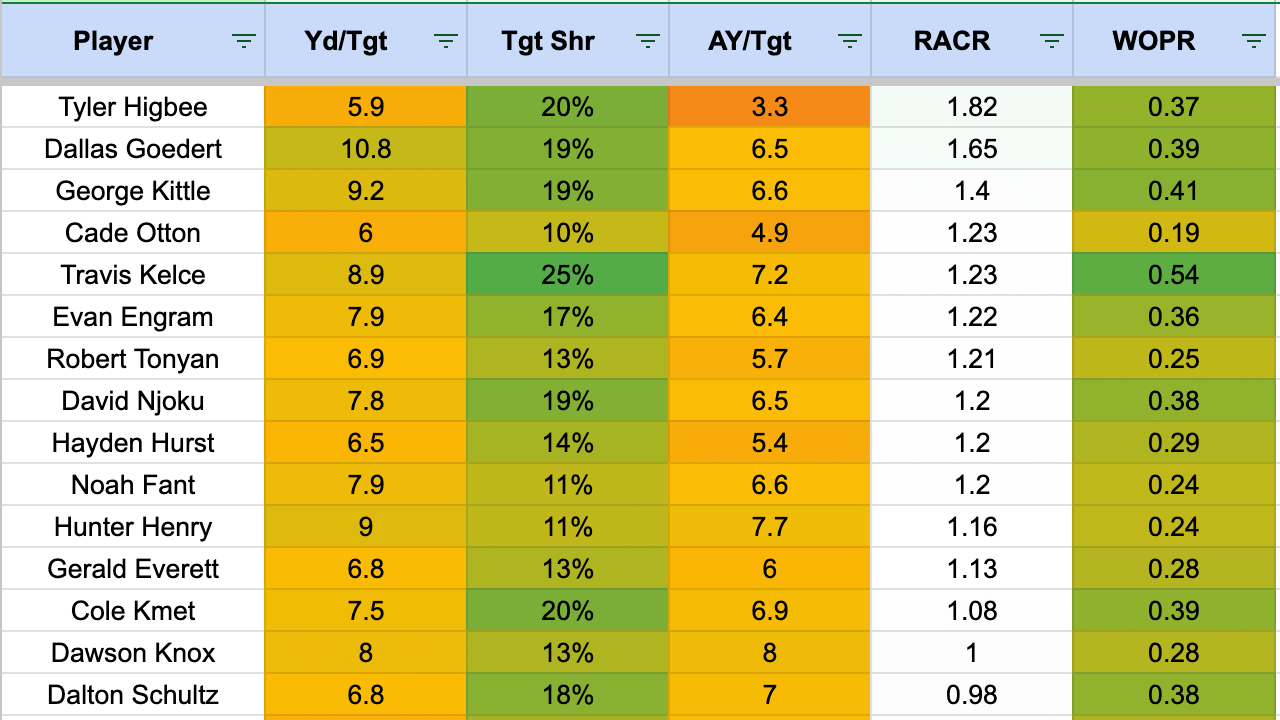

Freiermuth garnered more opportunities in Year 2. His target share jumped six points to 19 percent (No. 7) in Year 2 after 13 percent (No. 20) as a rookie. He also earned targets deeper down the field with 8.4 air yards per target (AY/T). Due to the lack of touchdowns, given the volume, Freiermuth's efficiency fell to -0.5 fantasy points over expectation per game (FPOE/G). However, we'll trust the target volume as a path to fantasy points and touchdowns.

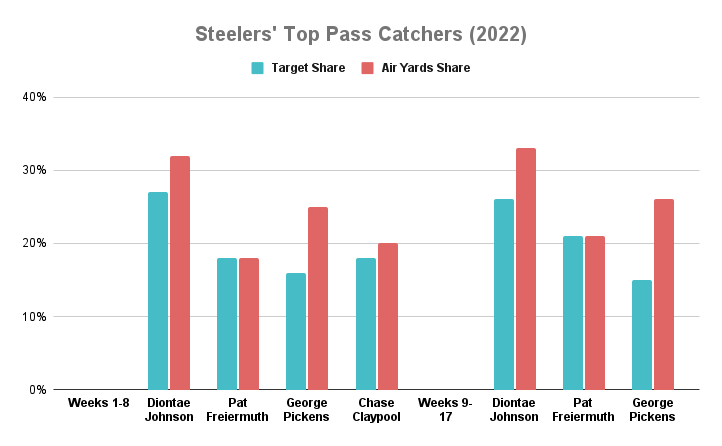

Before the Steelers traded Chase Claypool to the Chicago Bears, Freiermuth averaged an 18 percent target share, second on the team behind Diontae Johnson at 27 percent. Without Claypool, Freiermuth's target share bumped up two points to 20 percent.

Potential Pass Volume Concerns

Interestingly, the Steelers' pass rate dropped from 63 percent (No. 8) in Weeks 1-8 to 50 percent (No. 26) in Weeks 9-17. They still ran a ton of plays with 66 per 60 minutes (No. 16) in Weeks 1-8, which jumped to 69 (No. 4) in 9-17. The team shifted toward the run in the second half of the season, coincidentally without Claypool. That could indicate reservations and struggles with Kenny Pickett, evidenced by his brutal 5.1 adjusted yards per attempt (No. 33).

There's a scenario where George Pickens eats into Freiermuth's volume in Year 3, hurting the tight end's value. It's also reasonable to wonder if the Steelers lean more on the run game like in the latter half of the season. While Pickett likely continues his inefficient passing production, let's hope the volume buoys the value of their skill players.

As a passer, Pickett ranked 11th in on-target percentage (77.9 percent) behind Geno Smith. When pressured, Pickett's on-target rate improves to 80.4 percent (No. 1) with a minimum of 25 pass attempts, though his AY/A (2.9) ranked 25th out of 49 qualified quarterbacks. On-target percentage isn't a perfect stat, but Pickett has the skill players to make plays if he continues to make accurate passes.

Final Takeaways

Dallas Goedert, Jordan Reed, Jermaine Gresham, Engram and Hockenson came up when looking at Freiermuth's closest comparisons in Years 1 and 2. That accounted for their receiving expected points and FPOE/G with their draft capital and size. Gresham peaked in Year 3 as TE10, with Reed as TE2 in his third season. Goedert took a few years to reach TE8 in Year 4 but provided quality per-game production after Year 1.

After a historic rookie season, Engram underperformed relative to expectations for a few seasons but had a resurgence in 2022. Hockenson and Freiermuth produced and earned similar roles in Years 1 and 2, but Hockenson went in the first round. Freiermuth's market value as TE8 is likely the floor with a top-five ceiling outcome for multiple weeks thanks to his steady or increased volume.

Greg Dulcich, Denver Broncos

Greg Dulcich, Denver Broncos

Miller's TE8 vs. KTC TE13

The positive preseason expectations for the Denver Broncos last year fell flat, as they ranked 27th in total offensive EPA/G (-5.58). That ranked them near the Cardinals and ahead of the Commanders, Titans, Jets, Colts and Texans.

Russell Wilson struggled in his first season with the Broncos, and RB Javonte Williams suffering a season-ending knee injury in Week 4 didn't help. Despite offensive struggles, Greg Dulcich performed well after missing the first handful of weeks because of a hamstring injury.

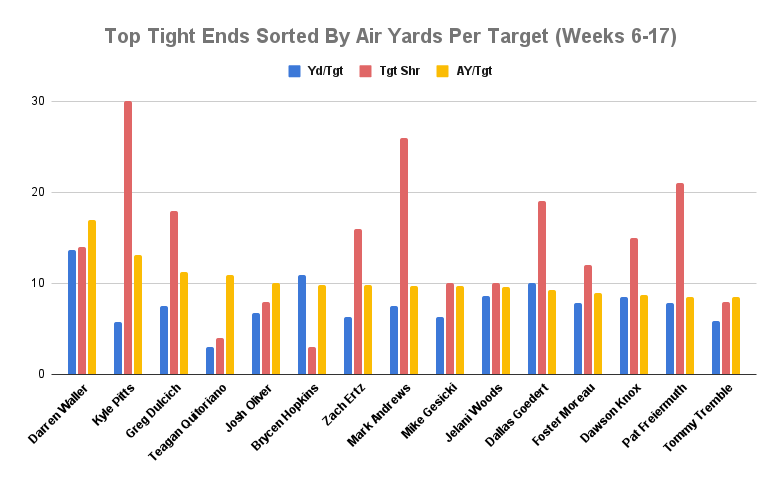

After Dulcich's debut in Week 6, he ranked 11th in target share at 18 percent, tied with Engram. Dulcich garnered a downfield role with the third-highest AY/T at 11.3. He finished behind Darren Waller at 17 AY/T (No. 1) and Kyle Pitts at 13.1 (No. 2) with a minimum of 10 targets since Week 6.

Though it's challenging to convert a high amount of those air yards into receiving production, Dulcich posted a respectable 0.66 receiving air yard conversion ratio (RACR), ranking 32nd among tight ends. It allows Dulcich to have a higher ceiling when he hauls in the deep targets, but it comes with boom games and inconsistency.

Final Takeaways

Dulcich's downside involves running fewer than 70 percent of the team's routes last season and a 20 percent TPRR after Week 6. On the flip side, Dulcich ran the third-best route rate on the team behind Jerry Jeudy and Courtland Sutton.

That indicates he'll likely remain the third option in the receiving game, if not the fourth behind rookie Marvin Mims. Maybe that keeps Dulcich as one of the undervalued tight ends to target for an early second-round pick like Ian notes.

It's a mixed bag of rookie comps for Dulcich, including Dwayne Allen, Noah Fant, Ian Thomas and Albert Okwuegbunam. Another 2022 rookie, Trey McBride, came up since Dulcich showed above-average, but not elite, athleticism like Fant and Okwuegbunam.

Sean Payton is the Broncos' new coach, and there have been several fantasy-viable tight ends on Payton's teams, including Jimmy Graham, Jared Cook, Coby Fleener and Taysom Hill. Though Dulcich will never command a high target share, the downfield role keeps his weekly ceiling high. Target Dulcich as a way to chase upside.

Gerald Everett, Los Angeles Chargers

Gerald Everett, Los Angeles Chargers

Miller's TE26 vs. KTC TE31

In Gerald Everett's first season with the Los Angeles Chargers, he peaked in total targets at 86 (No. 9) with an underwhelming 13 percent target share (No. 22). Though his efficiency fell in FPOE/G to -0.5 (No. 112), he had the 14th-best RACR, meaning he does well at converting air yards into receiving production. Everett typically ranks highly in RACR, making it a skill he can efficiently use.

Everett's target share doesn't impress, but we're digging deep into the player pool to find undervalued tight ends. The Chargers ranked third in pass rate in 2022 and sixth in 2021. With the addition of Quentin Johnston, plus the rest of the receiving core intact, including Austin Ekeler, the Chargers' pass rate should remain high.

Since Everett typically has a low AY/T, it's positive to see him gain yards after the catch with 5.6 (No. 10) in 2022 and 5.2 (No. 13) in 2021. We know he possesses the near-elite athleticism to make plays after the catch.

Final Takeaways

When digging deep into the bargain bin of undervalued tight ends, it's easy to poke holes in a player's profile. There's something to say about Everett's relative consistency as a backend option as TE18 in PPR/G and TE17 in EP/G during the past two seasons.

Everett is a cheap option at the position as a backend TE2 producer with at least one or two more years of value in dynasty formats, though he may need to find a new team after 2023.

Follow The 33rd Team Podcast Network on Spotify and Apple Podcasts.