Expert Analysis

2/2/24

7 min read

Why Tight Ends Are Best Value In Modern NFL

In the offseason after the San Francisco 49ers and Kansas City Chiefs met in Super Bowl 54, tight ends George Kittle and Travis Kelce signed contract extensions. Four seasons later, the Chiefs and 49ers are back in the Super Bowl with Kelce and Kittle still playing major roles in the offense and those contracts have played a role in helping build the current rosters for these two teams.

At the time of the signing, those deals set the top of the market for tight ends. Kittle’s contract averaged $15 million per year and Kelce’s averaged $14.3 million. Even then, those deals were well below the top of the market for wide receiver contracts — in fact, those figures would not have been inside the top 10 of receiver deals — even though Kittle and Kelce were capable of putting up receiver-like numbers in the passing game.

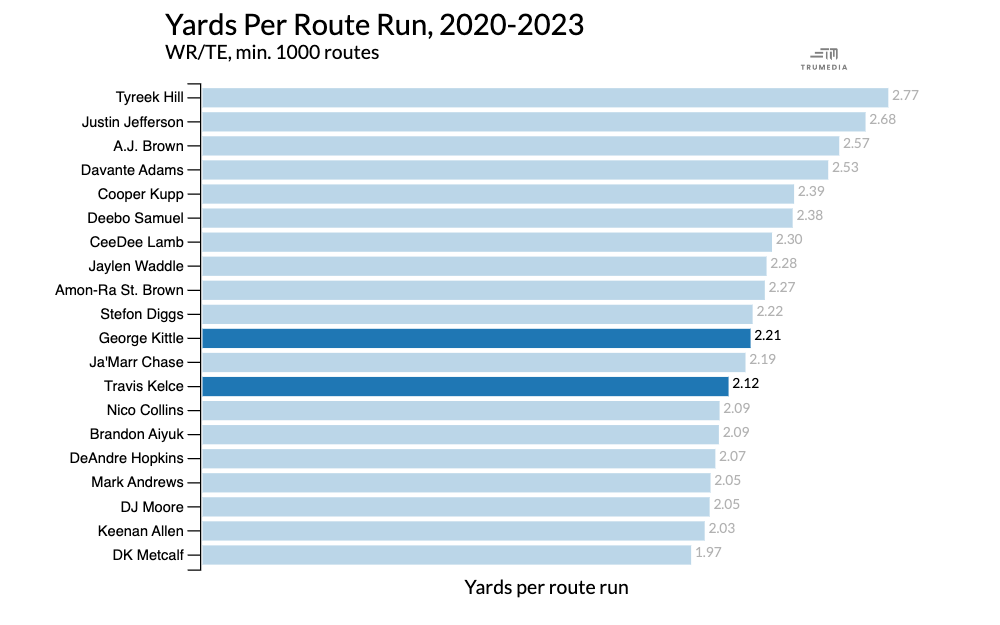

During the past four seasons, Kittle and Kelce have been among the most efficient receivers on a per-route basis while ranking 11th and 13th in total routes run in that period.

Just this season, Kittle finished as the AP first-team All-Pro at tight end. While Kelce’s play time was limited more than usual as he battled through some injuries, he was still one of the more efficient route runners in the league during the regular season, and now he’s second in yards per route run and leads players in EPA per route in the playoffs.

There’s still a market inefficiency here with the top tight ends who take up a significant role in the passing game.

Just this year, Kittle led the 49ers in routes run and was second in target share and receiving yards behind Brandon Aiyuk. Aiyuk has his fifth-year option remaining for the 2024 season which will cost $14.1 million. The 49ers could also extend him a year early to avoid entering next season as the final year of his contract, but any Aiyuk extension should easily cross the $25 million per year threshold.

Meanwhile, Deebo Samuel signed a contract extension in 2022 that averages $23.85 million (seventh among wide receivers) with a three-year cash flow of $71.5 million (fifth).

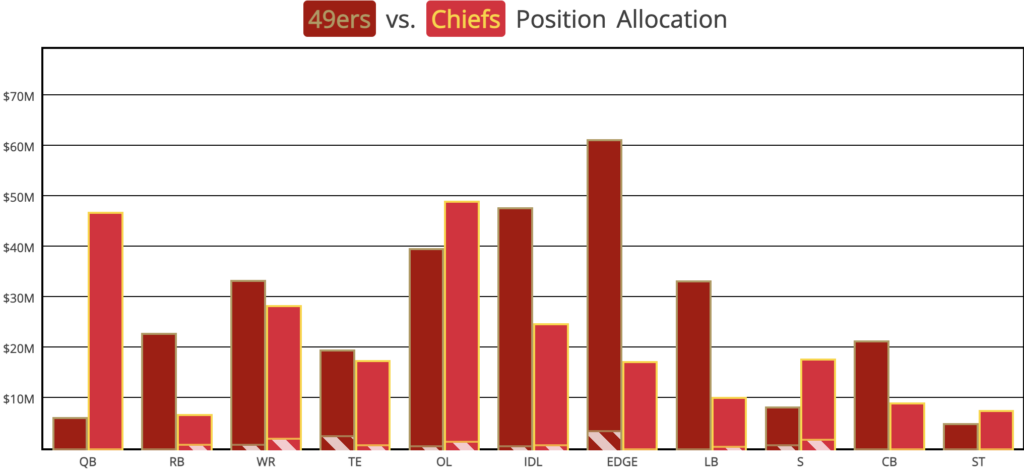

We don’t have to get into who is the most important of that trio for San Francisco but having Kittle on a contract nearly $10 million per year cheaper than Samuel’s will allow the team to keep that trio together in the future. Of course, it should be noted the seventh-round rookie contract for Brock Purdy is the ultimate cheat code for surplus value.

But even before Purdy came on, Kittle’s relative value has opened up space that has allowed for extensions for other players such as Nick Bosa and Fred Warner or taking on a player like Christian McCaffrey via trade.

The same benefit has come from Kelce, who took over as the true No. 1 receiver for the Chiefs once Tyreek Hill was traded away. Instead of paying Hill the $30 million per year price tag he was looking for, Kansas City was able to move on and go cheaper at the position.

That’s been an inconsistent affair outside of Kelce, but those savings have allowed the Chiefs to invest in the offensive line, bring in some key defenders and be a team that can get by supporting a quarterback with a massive cap hit.

For both of these teams, it’s top WR1 production or close to it at a cost closer to some WR2s.

Not all teams can have a George Kittle or Travis Kelce to build around, but this goes beyond just these two players.

Since the Kittle and Kelce contracts were signed, the tight end market hasn’t moved much while the wide receiver market exploded. Darren Waller now leads tight ends with a $17 million per year contract. T.J. Hockenson signed a contract this past offseason for $16.5 million per season and a position-pacing $48 million in three-year cash, per OverTheCap.

Among wide receivers, Waller’s average salary would rank 17th, and Hockenson’s three-year cash value would rank 16th. There are currently 13 wide receivers making at least $20 million per year, and 10 wide receivers have a three-year cash flow of at least $60 million.

Mark Andrews signed an extension with the Ravens in 2021 for $14 million per year. Baltimore gave Odell Beckham Jr. $15 million for the 2023 season alone.

Across the league, the average cap hit for a No. 1 receiver in 2023 was $14.7 million per OverTheCap, while the average for a No. 2 receiver was $6.4 million. The average for a No. 1 tight end was $7.9 million.

Yet, we’ve seen a number of these tight ends either act as No. 1 receivers or completely change the dynamic of an offense, such as Hockenson’s impact on the Vikings once he was traded.

This isn’t a gap that is expected to be closed anytime soon. This current free agent class of right ends is underwhelming, so setting a new precedent won’t be done on the open market this season. But we have seen an influx of young players at the position who will either reset the market or become the next values for long-term contracts.

While tight end has historically been a position that takes time to develop — sometimes into a second contract or team — players like Sam LaPorta, Dalton Kincaid, and the Green Bay Packers duo of Luke Musgrave and Tucker Kraft flashed immediately. Then there were second-year tight ends like Trey McBride, Jake Ferguson, and Isaiah Likely. All of these players could be key pieces in top passing games over the next few seasons.

Perhaps the most interesting case here will be Kyle Pitts. Pitts, a former fourth-overall pick, has been inconsistent due to injuries, usage and quarterback play during his first three seasons. But as that high pick, he’s more expensive than a typical rookie contract tight end. That’s especially true for the upcoming fifth-year option, which the Atlanta Falcons will have to decide on this offseason.

Per Over The Cap, the fifth-year option for Pitts is projected to be $10.6 million. He gets a raise because of making a Pro Bowl but because of his position, he’ll still fall below the market for receivers drafted around him because of the positional adjustments. The fifth-year options are based on the positional market, not just where the player was drafted.

Ja’Marr Chase, picked fifth overall, gets a multiple Pro Bowl bonus and will have a projected $21.7 million fifth-year option. Jaylen Waddle, picked sixth overall, has not made a Pro Bowl and will still have a $15 million fifth-year option. DeVonta Smith, also without a Pro Bowl, would also get that same option as a top-10 pick. Even Kadarius Toney and Rashod Bateman, picked later in the first round, would have $13 million fifth-year options while failing to hit the first level of playtime bonuses.

Had Pitts made multiple Pro Bowls like Chase, his max fifth-year option would only be $12.3 million — below the price of the lowest option for receivers selected in the 20s.

Pitts hasn’t shown the consistent ability to be one of the tight ends whose production equates to that of the top wide receivers — though we should not gloss over a 1,000-yard rookie season — but he could still provide significant contract value if a new offensive coaching staff (and possibly better health) can get him to that level.

>>READ: Latest 2024 Mock Draft

This is also a look into the possibilities of Georgia tight end Brock Bowers getting selected with a top-10 pick in the upcoming draft. The positional value is not skewed by using a pick that high in the draft and there is still a chance to have surplus value at the end of the deal.

Kelce and Kittle have defined an era of tight ends. They’re still the class of the position and their abilities will be highlighted in the upcoming Super Bowl matchup. Their salary value also gives their teams a benefit other positions can’t provide at the top of the market.

>>WATCH: Super Bowl Preview

Time will tell whether their production can spark a change in how tight ends are compensated or if this next great group of young tight ends will continue to provide the same type of value while continually producing like their peers at wide receiver.