Analysis

8/11/23

9 min read

Colts, Jonathan Taylor Will Set Precedent for Future RB Contracts

One of the offseason's biggest storylines has been the trio of franchise tenders offered to three of the NFL’s most prominent running backs – Saquon Barkley, Josh Jacobs and Tony Pollard – instead of lucrative contract extensions.

Pollard quickly signed his franchise tender on March 23. Barkley did not sign his tender; rather, he renegotiated a slightly more favorable, one-year contract with the New York Giants when the July 17 multi-year extension deadline for franchise-tagged players passed.

Barkley received $2 million of the $10,091,000 at signing and garnered an additional $909,000 in performance incentives instead of the traditional franchise tender compensation structure. As for Jacobs, he has yet to sign the tender. If he decides to play in 2023, it must be on the tender or another deal akin to Barkley’s.

Compensation aside, these three players are among the NFL’s premier offensive weapons. Jacobs posted the most scrimmage yards among running backs in 2023, with 2,053. Barkley ranked fifth with 1,650, and Pollard ranked 12th with 1,348, despite being them being the only two players in the top 12 other than Alvin Kamara to play fewer than 17 games.

Pollard also tied Jacobs for the sixth-most touchdowns (12) from scrimmage among running backs last year. Barkley ranked 10th in the NFL among backs with 10 TDs.

Do owners want to pay the players or not? It appears the NFL market doesn't. The million-dollar question is, “Why?” For starters, running backs suffer more injuries than other positions.

Decreasing RB Value

A 2016 study conducted by Michael Getz at Pro Football Logic found that running backs have the highest chance (5.2 percent) of suffering an injury that will keep them out for at least one week during an NFL game. Also, running backs’ injuries keep them out the longest on average (3.9 games).

It is prudent to pay running backs with extreme caution. Still, you must question whether that is the reason behind all of this.

In 2013, Adrian Peterson was the highest-paid running back in the NFL, with a deal worth $26.53 million annually (adjusted to the 2023 salary cap). Christian McCaffrey is today’s gold standard of running back contracts, earning $18.1 million (adjusted to the 2023 salary cap). Only nine years separated these two contracts; both players performed exceptionally the year before signing.

In fact, McCaffrey scored six more touchdowns (19) and gained nearly 750 more yards from scrimmage than Peterson in their contract years. Further, McCaffrey had not missed a game in his career at that point. Yet McCaffrey’s contract is 46.12 percent less valuable than Peterson’s per year, adjusted to reflect salary cap inflation.

While that is a stark comparison, the same holds for the top 10 highest-paid running backs in 2013 vs. the top 10 now. Overall, there is a 27.3 percent decrease in average value per year for the top 10 highest-paid backs.

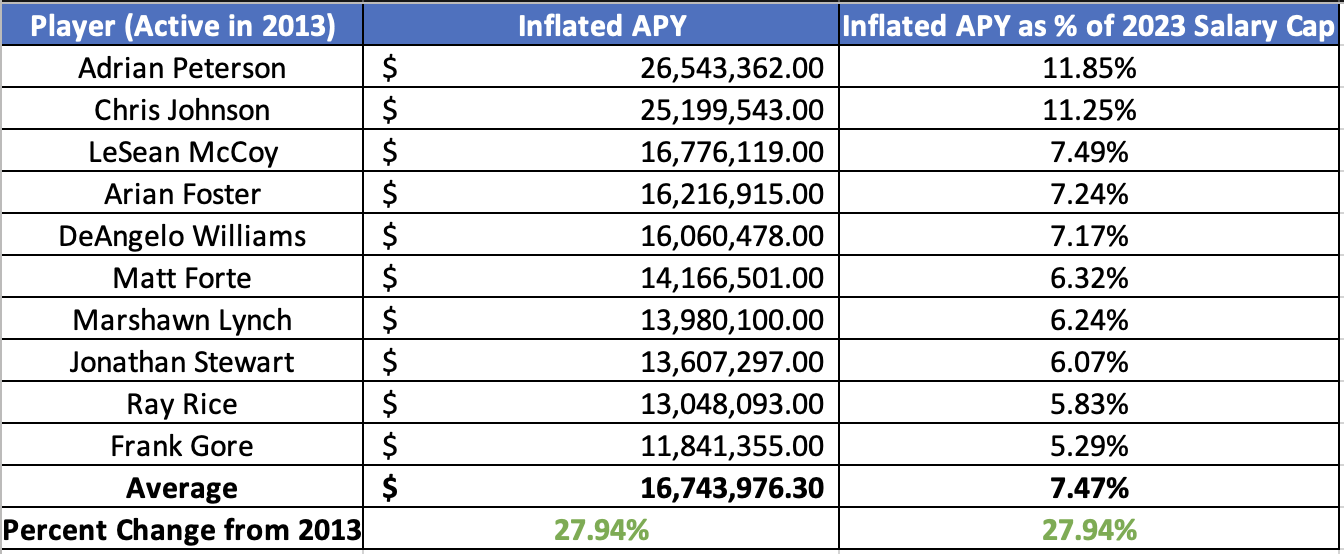

This table lists the top 10 running backs from 2013 by inflated average per year (APY):

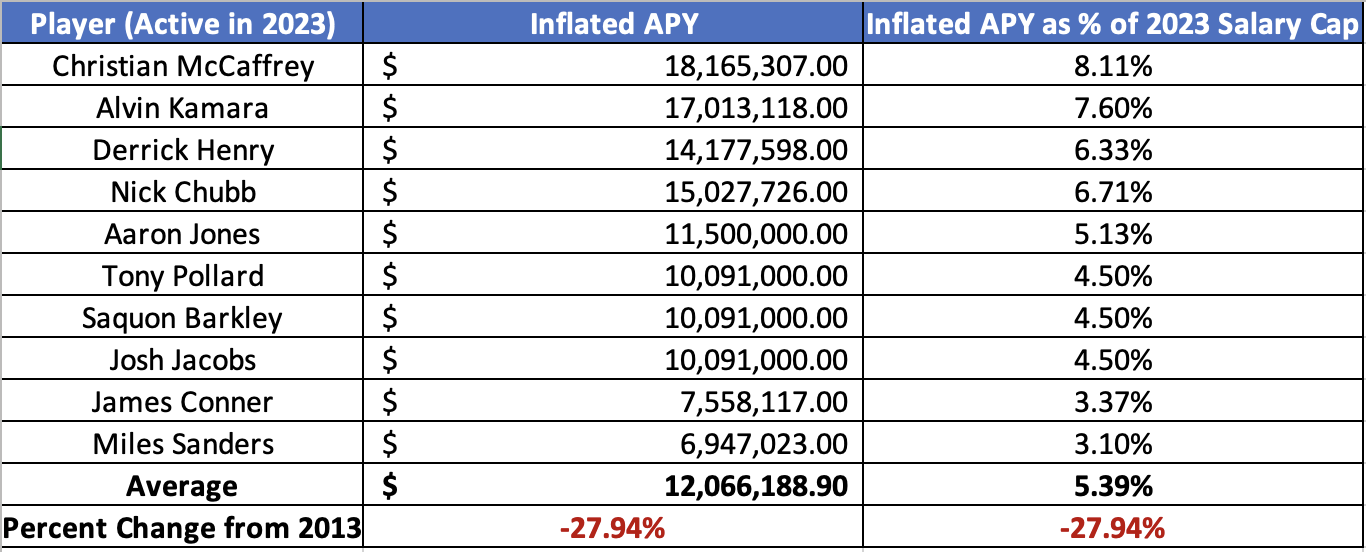

This table lists the top 10 running backs from 2023 by inflated APY:

All of these numbers equate to a 2.73 percent decrease in running back contracts per year since 2013, which we can use to estimate market value moving forward.

Franchise Tag is the Way

Moreover, the value of the franchise tender for running backs has also decreased. In 2017, when Le’Veon Bell played on the tender, it was worth $16,314,826, adjusted to the 2023 salary cap. In 2023, the running back franchise tender was worth $10,091,000. This discrepancy shows an even larger disparity — a 38.6 percent decrease in value.

In short, the tender is becoming a popular option for teams when dealing with running backs because it is cost-effective. In six years, the tender has decreased in requisite cash without adjusting for the salary cap between seasons. The result is clear and detrimental to progress for backs in the NFL.

The fact is that Nick Chubb is the only player to eclipse $12.2 million per year since Kamara and McCaffrey set the market in 2020 with deals worth $15 million and $16.01 million per year, respectively. While there is more to contracts than yearly value, it is a relatively stable measuring stick unless it is a harshly backloaded contract with few guarantees. The drastic change in running back salaries since 2020 has led to a team-friendly tender situation.

There is light at the end of the tunnel, albeit dim. According to Over the Cap, the projected running back tender next offseason will be nearly $13,051,000 — a 22.7 percent increase over 2023’s tender. Any running back who signs the tender next year would instantly become the third-highest-paid running back for 2024 instead of outside the top five, as we saw this year.

So what’s next?

2024 RB Market

Next year’s market will be star-studded. Pollard, Barkley and Jacobs are free agents again. Derrick Henry and Austin Ekeler will be unrestricted free agents. Jacobs, Henry, Barkley and Ekeler account for four of the top six running backs from 2022 in terms of yards from scrimmage. Add in Pollard and they make up five of the top 12.

More importantly, 2021 AP first-team All-Pro, Jonathan Taylor, will be eligible for an extension next offseason. Already, there is dissonance in Indianapolis.

Taylor is the only running back since David Johnson in 2016 to record more than 2,000 yards from scrimmage and score 20 touchdowns or more. As such, he is a unique, game-changing offensive player, and his market value should reflect that. However, in this current climate, it likely does not.

In reality, as a second-round pick in 2020, Taylor was not eligible for the fifth-year option this spring, which would have been $8,429,000. In a sense, Taylor dodged a bullet because the team would have likely exercised that option. Still, Taylor enters the final year of his rookie contract, seemingly at odds with Colts owner Jim Irsay.

>> PAGANO: Colts Can't Afford to Lose Taylor

Evaluating Taylor's Situation

A couple of nuances to Taylor’s situation need mentioning.

First, Taylor would take a massive risk if he refused to play. According to Article 8, Section 2 of the NFL Collective Bargaining Agreement, players with fewer than four “accrued” seasons have diminished negotiating rights. “Accrued” seasons are a way of quantifying a player’s time and experience in the NFL.

According to Article 8, Section 1, players “accrue” a season if they are on the IR, the PUP list or an active roster during six games. If they are on the practice squad, commissioner’s exempt list or non-football injury list (NFI), any games occurring during that period do not count.

If a player has one or two accrued seasons after the expiration of their rookie contract, they become an exclusive rights-free agent, only eligible to sign with their former team. When a player accrues three seasons, they are a restricted free agent, so their team has the rights of first refusal and can match any offer the player garners. Lastly, a player is an unrestricted free agent if he accrues four or more seasons.

Having already accrued three seasons, Taylor will, at worst, be a restricted free agent next year. The Colts have already considered putting Taylor on the NFI list if he refuses to participate. If that continues through the season, Taylor will not accrue his fourth season to earn unrestricted free agent status. Therefore, the Colts could match any offer Taylor receives.

Taking what we know now, it is extremely unlikely Taylor will receive what Kamara or McCaffrey earned in 2020. Nonetheless, the tender — projected at $13,051,000 for running backs in 2024 — is not ideal for the Colts.

The team using the tender must absorb its entirety against the cap. On the other hand, a team has more cap flexibility when offering multi-year contracts. However, the tender is not a team’s only alternative to offering a contract.

According to Article 10, Sections 3 and 4, a club may issue a transition tender, which functions similarly to a franchise tender. The main difference is the transition tender costs less and provides less protection.

A player under the transition tender is essentially a restricted free agent. He can negotiate contracts with other teams. However, his previous team can match any offer. This is an effective tool when the player and team are not close in the valuations of a potential contract.

This leaves a window between the projected tender of $13,051,000 and the average of McCaffrey and Kamara’s per-year value of $17,589,212.50 adjusted to the 2023 salary cap. The question for the Colts is whether Taylor’s asking price is more or less detrimental than absorbing the tender in 2024.

As mentioned before, it’s unlikely Taylor’s deal will reach $17 million. Remember, Chubb is the only running back since McCaffrey and Kamara signed who earns more than $12 million annually.

However, Taylor’s 2021 season was among the best in the past decade. He missed six games last year and likely would have had a strong season without his injury. Unfortunately, teams rarely, if ever, deal in hypotheticals. Furthermore, that injury will likely arise in negotiations, providing a legitimate reason for hesitation.

Still, Taylor’s market value is between $14.5 and $16 million. Taylor should be paid something in the ballpark of $15,250,000. After all, Chubb’s 2021 contract adjusted to the 2023 salary cap would be worth $15,027,726 per year. Then again, Chubb has never amassed 1,800 scrimmage yards or scored 14 touchdowns in a single season.

>> POLIAN: Viewing Taylor's Situation Through the CBA

Conclusion

It will be interesting to see how this situation unfolds, and it isn’t easy to predict, considering how swiftly NFL markets shift. Irsay and the Colts are tasked with setting the market, as the Giants, Raiders and Cowboys were this offseason. Those teams stood in solidarity with each other.

But half of the NFL’s elite rushers will be free agents next year. It will be difficult for teams to stand united when nearly 20 percent of the league (six teams) will not have their largest non-quarterback offensive contributors under contract.

To make matters worse, the franchise tender will be much less friendly next year than it was this year. Over the Cap projects it will increase by 22.7 percent. For reference, the salary cap increased only 7.9 percent from 2022.

Taylor’s deal will set a precedent, another reason the Colts will proceed cautiously. Ultimately, the Colts, and other similarly situated clubs, will have to decide whether they want to:

- Absorb the projected tender of $13,051,000 in its entirety against their 2024 team cap.

- Issue a transition tender and see how it plays out.

- Reach a deal amenable to both parties, which is worth more cash but allows cap flexibility.

- Let their running back leave for a new team.