Analysis

3/24/22

10 min read

Free Agent Spending vs. Long Term Success: Part 2

In Part 1 of this series, we discussed the historical results that the top three spenders in free agency alone each offseason have experienced over the past 10 years. Of the 24 teams in the sample who had completed three or more seasons since the offseason where they spent big in free agency, just 33% of them finished with a cumulative record over .500 in the first three seasons after spending. These teams included the 2019 Packers, 2019 Bills, 2018 Titans, 2018 and 2017 Bears, 2014 and 2012 Broncos, and 2013 Colts. In this piece we will study these eight teams and try to find a common denominator among them. We will also explore the teams who were .500 and worse to find commonalities to avoid among that group.

One key thing we noticed about all of the teams over .500 was that they all had high-level quarterback play during the three seasons included in the study. Five of the eight either already had a QB on the roster or acquired one who made the Pro Bowl the season prior to when the spending occurred. The remaining three were led by Ryan Tannehill as well as rookie and second year versions of Mitch Trubisky. There were only two other instances where a team spent big with a Pro Bowl QB as their starter — 2016 Raiders and Giants.

| 3yr Tot After Spend | Player | Games | Pass Yds | TD | INT |

| 2019-21 | A. Rodgers | 48 | 12416 (5th) | 111 (1st) | 13 |

| 2019-21 | J. Allen | 49 | 12040 (7th) | 93 (6th) | 34 |

| 2018-20 | M. Trubisky | 39 | 8426 (19th) | 57 (20th) | 30 |

| 2014-16 | P. Manning* | 26 | 6976 (14th) | 48 (15th) | 32 |

| 2013-15 | A. Luck | 39 | 10464 (15th) | 78 (10th) | 37 |

| 2012-15 | P. Manning | 48 | 14863 (2nd) | 131 (1st) | 36 |

These teams’ clearly had impressive QB play, as their stats are shown, as well as their NFL ranks in passing yards and TDs during the three span following the spending. The 2014 version Peyton Manning only includes a two-year span as he retired after the 2015 season.

It makes sense that these teams would thrive after adding talent to surround a star quarterback. However, just spending wasn’t enough.

When studying the “texture” of the money spent — namely, the amount of large contracts (over $66 million in total value) handed out — we noticed something interesting. Just one of the eight teams gave out an agreement that exceeded $66 million in total value. That team was the 2012 Broncos and that contract was given to free agent QB and future Hall of Famer, Manning. In comparison, eight of the 16 teams who did not have winning records in the sample time frame did agree to such a contract. While this is admittedly a somewhat crude and seemingly arbitrary cut-off amount, the results speak to the greater point that spending mass amounts on one player (especially when that player is not a QB) might not be the ideal way to construct a roster.

With this in mind, we wanted to explore whether these teams were handcuffing themselves with guaranteed money, leading to an inability to spend down the line. Looking at the percentage of total money given out that was guaranteed, there was little to no correlation between guaranteed money and long term success. The 2019 Packers spent just 30.84% as guaranteed money (15.73% less than the league average) and wound up with a .765 win percentage over the three seasons. On the other hand, the 2014 Broncos earmarked 51.76% of their spending as guarantees (15.7% more than the league average) and had a winning record each of the three seasons used in the sample.

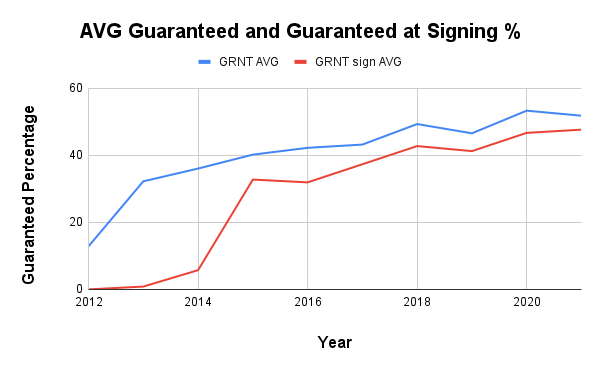

What we did notice is that league average percentage of fully guaranteed money as well as fully guaranteed at signing has increased dramatically over the last decade. In 2012, the league average for total guarantees and guaranteed money at signing were 12.88% and 0.02%, respectively. Those figures in 2021 were 51.82% and 47.66%. Additionally, the gap has narrowed between total guarantees and fully guaranteed money at signing. In 2014, the first year teams really started fully guaranteeing money at signing, these figures were 36.06% and 5.75%. These figures have steadily increased to less than a 4.5% difference.

With guaranteed spending increasing league-wide, as evidenced by Deshaun Watson’s 100% guaranteed $230 million contract extension and Tyreek Hill’s $52.5 million fully guaranteed at signing, with another $19.7 million guaranteed the following year, guaranteed money percentage might not be the best indicator of free agent spending moving forward.

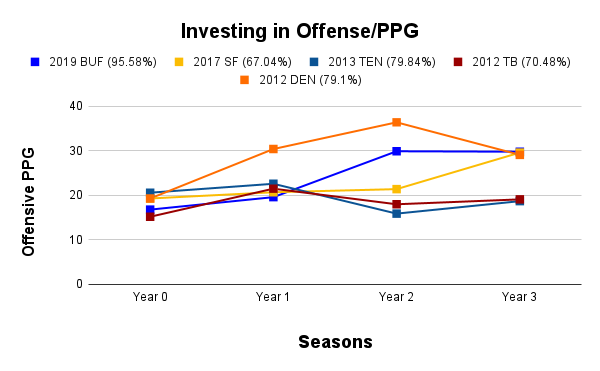

Going back to the texture argument, we decided to look into each team’s spending on each side of the ball and compare it to their improvement (or lack thereof). For example, the 2019 Bills spent 95.58% of their free agent money on the offensive side of the ball. Buffalo was able to increase their total points per game from 16.8 in 2018 to 19.6 in 2019 and then to 31.3 in 2020. We’ve outlined a few of these instances from the offensive side of the ball in the graph below.

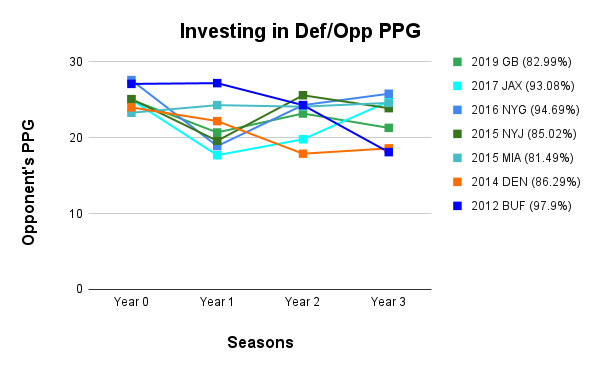

This does not necessarily correlate with the defensive side of the ball. While the 2014 Broncos and 2012 Bills saw sustained success after spending more than 86% of their free agent money on that phase, the 2017 Jaguars and 2016 Giants both spent more than 93% of their free agent money on defense, yet their defenses were in just as bad of a spot three years down the line as they were before spending.

For the 2020 Bengals, who spent 91.68% of their free agency contracts on the defensive side of the ball, they did not see a first year improvement unlike most other teams highlighted. Their opponent’s PPG was nearly identical from “year 0” to “year 1." However, in 2021 they finally saw the leap they were looking for as they decreased their opponent’s PPG to just 21.8. While they performed well in the regular season, it was the playoffs that showed off the talent Cincinnati had accumulated on defense, as they were a key part in their Super Bowl run.

Another high-spending team on defense from 2020, the Raiders, spent 78.3% of their free agency spending on defensive players. But they have yet to see the big jump in production that they have been looking for. Surely their defensive production could change this year after adding Chandler Jones.

Overall, we discovered that for teams to have success after spending big, it is vital that the team already has or adds a high-level QB to run their offense.

While investing heavily on the defensive side of the ball typically proved to be effective after one season, it did not commonly last long-term, as after a few years the unit was back to square one. On the other hand, the teams that were successful in spending spent highly on offense and did see some sustained success.

Lastly, as total guarantees and guaranteed at signing numbers increase season-over-season, it will be interesting to see the long-term consequences on roster building.

Uncharacteristically, the Patriots spent $288.7 million in free agency this past offseason. This figure doesn’t even include the contract of offensive tackle Trent Brown, who they acquired in a trade with the Las Vegas Raiders. Including this move increases the Patriots’ 2021 free agent spending above the $300 million threshold to $302.7 million — about $50 million less than their free agent spending from 2011 to 2020 combined. However, as you’ll see, New England's spending spree was not as reckless as it may seem to the naked eye.

To put the Patriots’ spending spree into perspective, the Miami Dolphins were the highest spenders in free agency in 2020 and spent only $236.76 million. The New York Jets spent the most in back-to-back free agencies at just $201.25 million and $194.47 million in 2019 and 2018, respectively.

Of the $288.7 million in total value that the Patriots have dished out, $155.03 million – or 53.70% of the total value – is fully guaranteed. That is less than 2 percentage points above the league average for guaranteed money given to free agents in 2021. Similarly, the 49ers (2021’s second-highest free agent spender) guaranteed just 37.61% of the $191.76 million they gave out in total contract value.

Comparatively, the 2020 Dolphins gave 61.88% in guaranteed money, which was significantly higher than the 53.32% that the league guaranteed as a whole. In 2019, the Jets gave 52.93% of the total value of their free agents’ deals as guaranteed money, 6.16 percentage points above the league average.

| Year | Team | Total FA spending

(in millions) |

Guaranteed Money

(in millions) ($) |

Guaranteed Money

(in millions) (%) |

League Average Guaranteed to FAs | Change

(%) |

| 2021 | Patriots | $288.7 | $155.03 | 53.70% | 51.82% | 1.88 |

| 2020 | Dolphins | $236.76 | $146.51 | 61.88% | 53.32% | 8.56 |

| 2019 | Jets | $201.25 | $106.51 | 52.93% | 46.77% | 6.16 |

| 2018 | Bears* | $172.31 | $102.04 | 59.22% | 49.33% | 9.89 |

| 2017 | Jaguars | $177.40 | $71.85 | 40.50% | 43.12% | -2.62 |

| 2016 | Giants* | $210.65 | $107.04 | 50.81% | 42.24% | 8.57 |

| * 2nd leading FA spender | ||||||

These figures prove that Belichick and the Patriots took a different approach to free agency than the spending leaders of the past. To further solidify that point, in 2020 the Dolphins gave Byron Jones a deal with $80 million total value. Similarly, in 2019 the Jets gave C.J. Mosley a deal with $85 million in total value and in 2018 they gave Trumaine Johnson a deal worth $72.5 million in total value.

The point here is that each of the spending leaders in free agency the past three seasons have handed out a deal worth at least $72.5 million in total value. This certainly hindered their ability to acquire more, quality players to fill out the roster. The Patriots did not do that to themselves. The highest total value of a contract signed in the 2021 offseason was OLB Matthew Judon for $54.5 million, spread over four years. Notably, Judon was a 2021 Pro Bowler and in the conversation for Defensive Player of the Year through the first half of the season.

Free agency has perils, but in recent years it has yielded immediate return. In each of the past 6 years, the top spender has increased its win total by at least 3 wins:

2021: Patriots +3

2020: Dolphins +5

2019: Jets +3

2018: Bears +7

2017: Jaguars +7

2016: Giants +5— Field Yates (@FieldYates) March 13, 2022

As detailed in the tweet above, spending in free agency is not always a bad thing. In fact, the spending leader in free agency each of the last five seasons has seen at least a three-win increase from the previous season.

The 2020 Dolphins saw a five-win increase. The 2018 Bears (who were No. 2 in free agent spending that year) and the 2017 Jaguars each saw seven-win increases, while the 2016 Giants saw a five-win increase. This trend held up in 2021 as the Patriots’ win total increased by three and the 49ers’ increased by four.

The issue with this type of spending is that it usually is not sustainable.

The 2020 Jets and 2018 Jaguars both saw five-win decreases from the seasons immediately following their league-leading free agent spending. Similarly, the 2019 Bears saw a four-win decrease from the 2018 season.

The worst of the past five free agent spending leaders was the 2017 Giants, who saw an eight-win decrease from the 2016 season. However, like the 2018 and 2019 Jets and 2020 Dolphins, each of the 2016 Giants, 2017 Jaguars, and 2018 Bears acquired at least one player who signed a contract above $67.5 million, hindering their ability to sign other talented players either via free agency or retain talent from their current roster.

| Team | Year Prior Record

(Year -1) |

Record that Season

(Year 0) |

Record Following Season (Year +1) |

| 2021 Patriots | 7-9 | 10-7 (+3 wins) | ??? |

| 2020 Dolphins | 5-11 | 10-6 (+5 wins) | 9-8 (-1 win) |

| 2019 Jets | 4-12 | 7-9 (+3 wins) | 2-14 (-5 wins) |

| 2018 Bears* | 5-11 | 12-4 (+7 wins) | 8-8 (-4 wins) |

| 2017 Jaguars | 3-13 | 10-6 (+7 wins) | 5-11 (-5 wins) |

| 2016 Giants* | 6-10 | 11-5 (+5 wins) | 3-13 (-8 wins) |

| * 2nd leading FA spender | |||

Another team that has a QB on his rookie contract is the Los Angeles Chargers who not so coincidentally are currently third in free agent spending this offseason — not even including the trade for Khalil Mack and the $63.9 million remaining on his contract. The Chargers spent $82.5 million on former Patriot CB J.C. Jackson as well as a $60 million extension for WR Mike Williams just before the signing period opened. Only time will tell if these deals are worth it or if the team is forced to chip away at their remaining roster in the coming years with an extension for Herbert looming after this season.