Analysis

10/17/23

9 min read

2023 NFL Week 6 High-Value Touch Report: Rushing and Receiving Data

Week 6 seemed like a lower-scoring one across the league and the data backs it up. In Week 6, teams averaged 17.8 offensive points scored per game and 4.9 yards per play, down from 21 offensive points per game and 5.3 yards per play in Weeks 1-5.

Five of the top 10 teams in yards per play lost in Week 6: the New Orleans Saints, Seattle Seahawks, Atlanta Falcons, Tennessee Titans and Philadelphia Eagles. Meanwhile, five of the bottom 10 teams in yards per play won: the New York Jets, Cincinnati Bengals, Minnesota Vikings, Washington Commanders and Jacksonville Jaguars. Yes, this is partly small-sample noise, but we expect efficient teams on a yards-per-play basis should fare well. That also aligns with some lower-scoring fantasy matchups.

Below, we’ll examine red zone goal-to-go (GTG) touches and opportunities. The context for these touches is important, so we’ll consider the potential game script that led to the usage. This information helps identify which players might be on the verge of scoring more touchdowns and fantasy points — and which players aren’t.

Given the small sample size, we sometimes find players don’t regress quickly or that the data becomes more noisy than meaningful. The information will be broken down by red zone and GTG rushing and receiving data to find usage patterns and expected fantasy points.

Red Zone Rushing, Plus the Ravens’ Backfield

Lamar Jackson, Josh Jacobs and Kenneth Walker led all rushers with seven red zone attempts in Week 6. Raheem Mostert and Saquon Barkley rounded out the top five. (We'll discuss Mostert more later because all six red zone attempts came in GTG situations). Jackson matched his season total of seven red-zone rushes in Week 6 for 14 on the season.

Though the Baltimore Ravens ranked second in rush rate (50 percent) behind the San Francisco 49ers at 53 percent before Week 6, the team continues to struggle to find consistency. Gus Edwards led the Ravens against the Titans with a 41 percent rush share, compared with Jackson’s 33.3 percent. That's similar to their season-long rush shares. Interestingly, the Ravens rank 12th in total offensive rush success rate, though they spread it through three primary rushers.

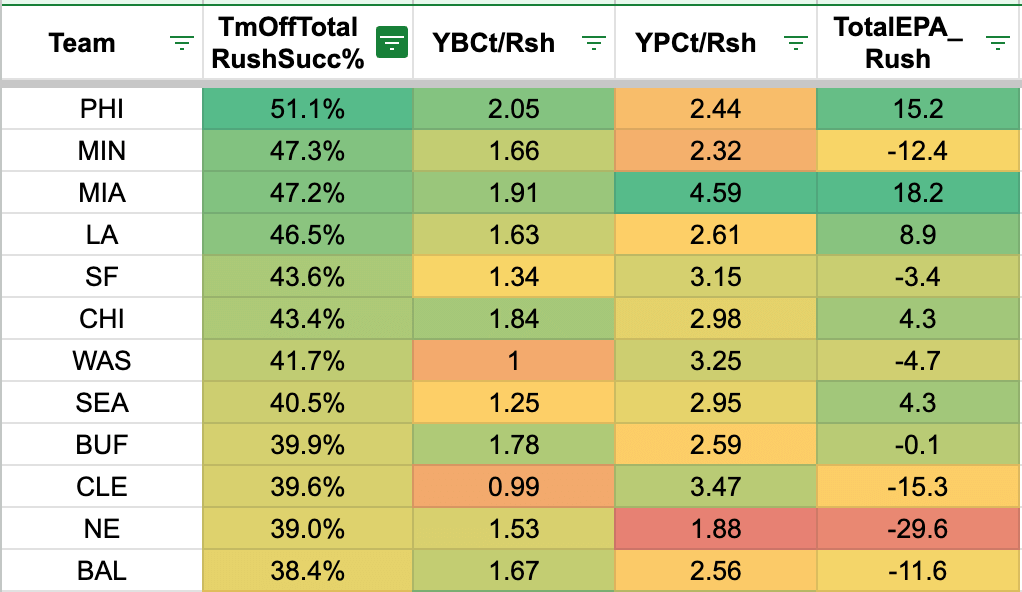

The visual below shows the team leaders in rush success rate, including other advanced stats.

Fade the Ravens' running backs and temper expectations because they're touchdown-dependent options with low floors, and Jackson will eat into their workload. However, keep tabs on rookie Keaton Mitchell, who was activated off of injured reserve.

Mitchell profiles similar to De'Von Achane, given Mitchell's speed, explosiveness and elite college production. I wrote about Mitchell after the NFL Draft as an exciting player among the undrafted free-agent running backs; he ranked ninth on my spreadsheet. It doesn't look like Mitchell has played a single snap on offense, but be patient in deeper leagues.

Saquon Barkley Returned to a Broken Offense

After missing a few weeks with an ankle injury, Barkley started slowly, with 16 carries for 23 rushing yards in the first half. Then, he exploded for eight carries for 70 yards in the second half. Interestingly, all six of Barkley's red zone carries came in the first half, though the explosive plays showed up in the second.

The New York Giants rank second to last in rush success rate. Most of the run game issues stem from their offensive line struggles and Barkley's injury. Unfortunately, the Giants' offense hasn't fared well; the team has the third-lowest red zone efficiency (31.3 percent) ahead of the Jets and Pittsburgh Steelers. Barkley gives the team juice, but he can't do it alone.

It feels like we’ve read this story before with Barkley and the Giants’ offense.

Red Zone Receiving

Week 6 seemed like the week of backup quarterbacks. The Giants, Indianapolis Colts and Cleveland Browns turned to other options due to injuries. Meanwhile, Josh Dobbs has held it down for the Arizona Cardinals, and his team-leading 47 rushing yards became the highlight. Marquise Brown was questionable due to an illness but remained Dobbs' favorite option with a 26.8 percent target share.

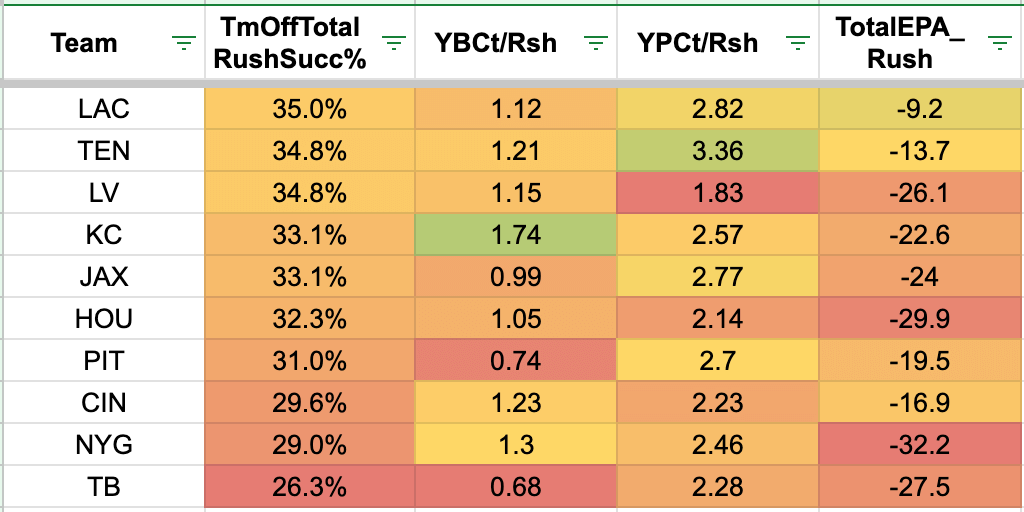

Brown is quietly showing up on the red zone target leaderboard, as seen below.

Brown tied for the weekly lead of red zone opportunities (three) with DK Metcalf and Josh Downs. With the Cardinals likely trailing, expect Brown to be an inefficient WR2. Without James Conner, they'll probably lean on the passing game, where they have the fifth-highest red zone passing percentage at 62.2 percent.

Downs made the most of his inefficient opportunities. Three of his eight targets came in the red zone. Two of them came in GTG situations, including his receiving score.

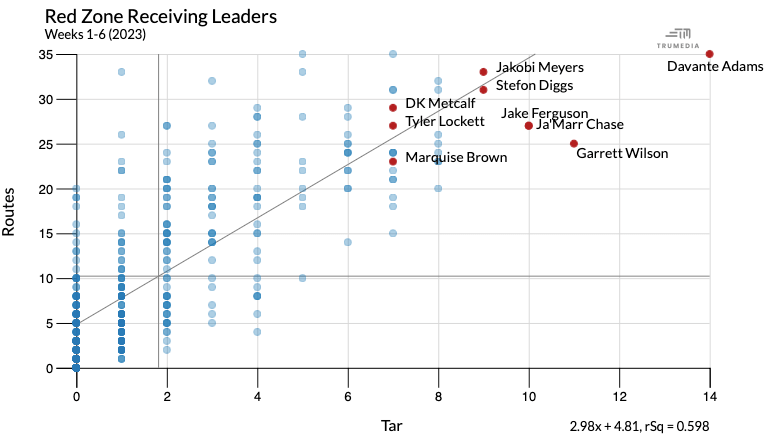

The visual below shows the game splits with and without Anthony Richardson at quarterback for the Colts' top two receivers before Week 6.

In four previous games with Gardner Minshew at quarterback, Downs averaged 10.8 points per reception (PPR), 7.5 targets, 5.3 receptions and 55.3 receiving yards. There has also been a slight bump in receiving production for Michael Pittman Jr.

Jonathan Taylor and Pittman tied with two red zone targets in Week 6, showing that Minshew is looking toward the team's best options. Though Taylor and Zack Moss struggled rushing, they garnered a healthy target share with 10.9 percent for Taylor and 12.7 percent for Moss.

Higher passing and play volume led to that, given the duo's 64 plays per game in Weeks 1-5 compared with 75 in Week 6. Buy low on Taylor, especially after two brutal games, because recency bias might be seeping in. And the Colts could continue running an up-tempo offense as mentioned last week.

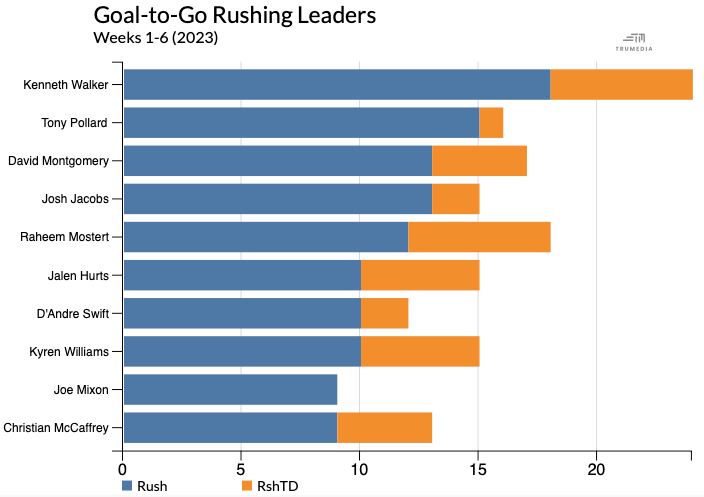

Goal-to-Go Rushing

With rookie sensation Achane hitting injured reserve, Mostert dominated in Week 6 against the Carolina Panthers. He posted his second 100-yard rushing and two-touchdown performance and finished with six GTG carries (No. 1), ahead of Walker (five). Mostert matched his previous total of GTG rushes in Weeks 1-5, showing the Miami Dolphins' trust in the veteran.

Mostert, Walker and David Montgomery have been fortunate with their touchdowns, given their offenses and usages. However, Tony Pollard, Jacobs and Joe Mixon could be due for touchdown regression.

Though we hoped Jeff Wilson would return, he didn't play this week. Salvon Ahmed and Chris Brooks had two GTG rushes in, but because it's a low total in a positive game script, we shouldn't overreact to the Dolphins' backup running backs. Mostert had 66.7 percent of the team's rush share in quarters 1-3, and Ahmed had 27.8 percent.

Ahmed came in as the other primary option in the first three periods, but Brooks took the closer role with a 40 percent rush share in the fourth quarter. If Mostert or Wilson miss time, target Ahmed and then Brooks before Achane returns.

Austin Ekeler returned Monday and struggled to gain yards on the ground, with 14 carries for 27 yards. However, three of his 14 carries came in GTG situations against the Dallas Cowboys. Los Angeles Chargers QB Justin Herbert has run more in the past two games. He has 18 rush attempts in the last two games compared with eight through the first three. If Herbert gets more fantasy points on the ground, it would add to his ceiling and floor, though it could take away an occasional goal-line carry from Ekeler.

It's Time to Sell Dameon Pierce

Edwards, Jackson and Dameon Pierce tied with three rushes in GTG situations yet combined for zero touchdowns. The Houston Texans' backfield became murkier as Devin Singletary evenly shared the rush share with Pierce (41.9 percent for Pierce vs. 38.7 percent for Singletary).

Singletary teased us in the past in Buffalo, and the veteran showed his skills to create more yards before contact in Week 6. It was the lowest rush share for Pierce since Week 1 (47.8 percent) and the highest for Singletary since Week 3 (34.6 percent). It's probably noise for Singletary because Pierce bests him in high-value rushes (seven vs. one).

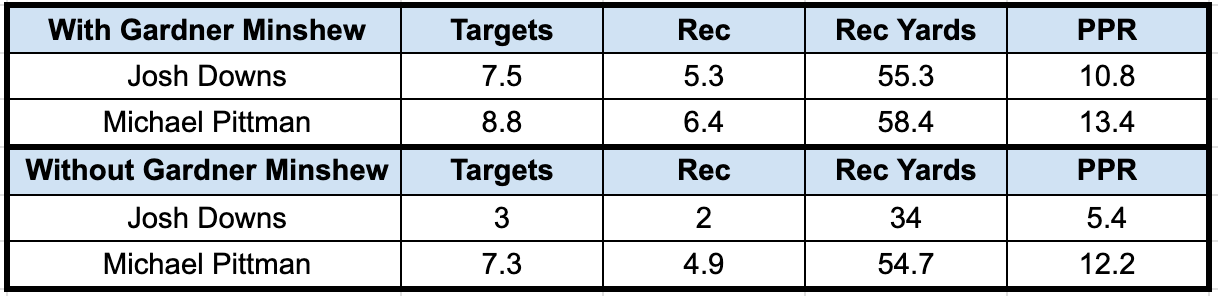

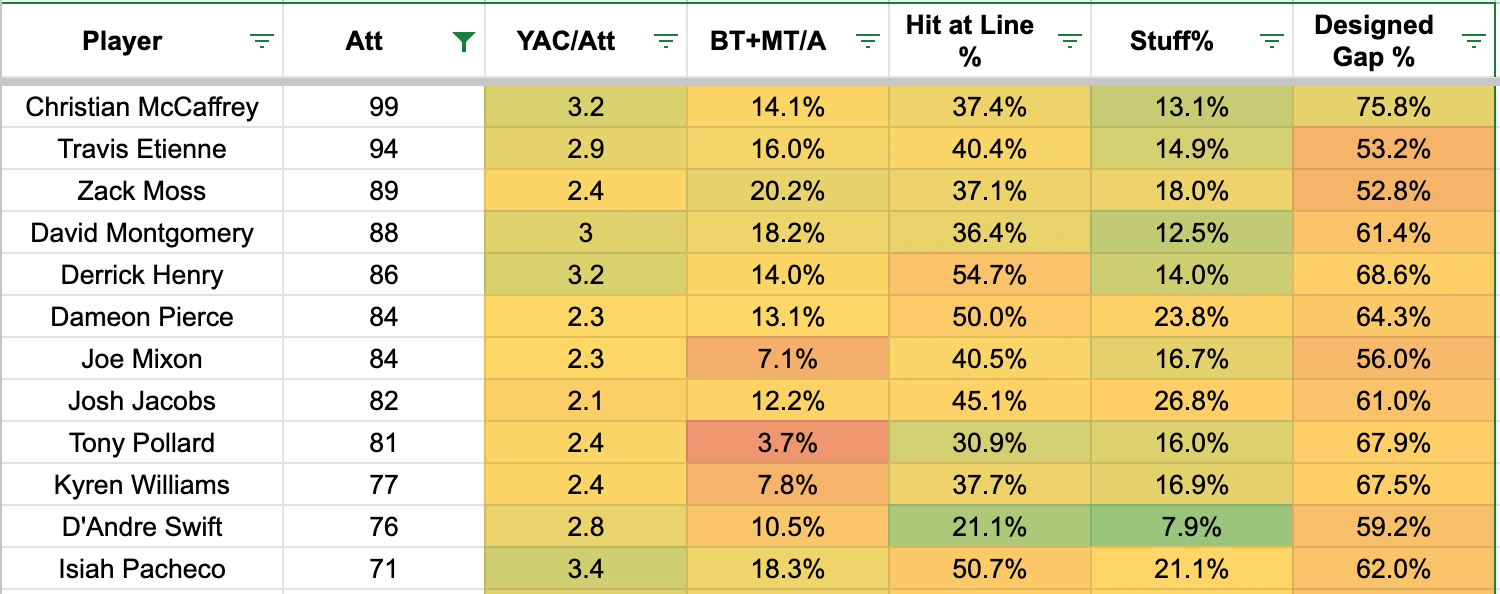

The visual below shows the middling advanced stats for Pierce among the leaders in rushing attempts in Weeks 1-5.

Pierce already had concerning metrics. He averaged 2.3 yards after contact per attempt (YAC/Att) and a 13.1 percent broken-plus-missed-tackle rate (BT+MT/Att). I'd recommend selling Pierce in a package if possible. Use Josh Larky's rest of season ranking and trade chart to gauge potential trade options.

Goal-to-Go Receiving

We'll touch on the most notable from last week as possible hints at actionable advice moving forward. With Barkley back, he remained an essential piece of the Giants' offense. That's evident via his high-value rushes and two GTG targets against the Bills. Unfortunately, Barkley's 13.9 percent target share translated into a measly five receiving yards.

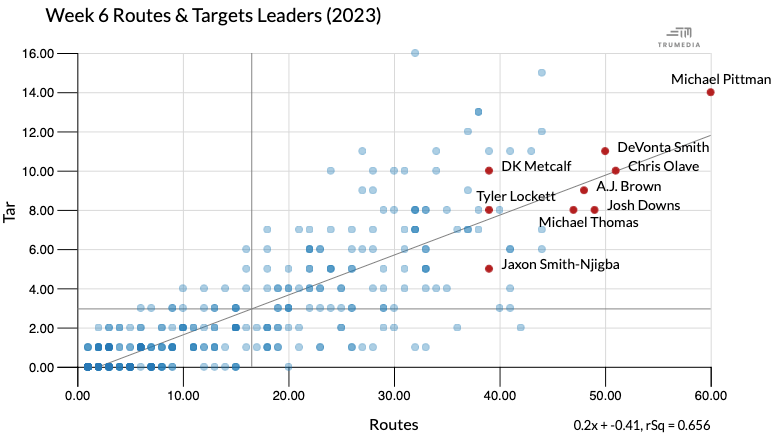

Metcalf left the game against the Bengals and then returned, which potentially gave rookie Jaxon Smith-Njigba hope. Smith-Njigba possesses tons of talent and contingent value if Metcalf or Tyler Lockett misses time. The rookie garnered two GTG targets in Week 6 and surprisingly has the most among Seahawks receivers (three). Walker leads the league at 18 GTG rushing attempts through six weeks.

Smith-Njigba ranked third in routes per game at 23 behind Metcalf (30.3) and Lockett (31.3) in Weeks 1-5. In Week 6, they tied with 39 routes each, indicating a potential increase for Smith-Njigba, so fantasy managers should keep stashing him.

The Seahawks ran more three-receiver sets, evidenced by the 10th-most 11-personnel at 71.4 percent in Week 6. In Weeks 1-5, the Seahawks ranked 23rd in 11-personnel at 53.2 percent. Acquire Smith-Njigba because Seattle projects to have a top-five schedule for receivers for the rest of the season.

Keenan Allen added two more GTG receiving opportunities to his season-long total of four. Allen scored a one-yard touchdown as he went in motion across the field. Interestingly, Donald Parham ranks second with six targets in these situations, scoring touchdowns on three of those. Expect these targets to shift toward Allen and Ekeler as the primary scoring options, though secondary opportunities could be the tight ends.

Follow The 33rd Team Podcast Network on Spotify and Apple Podcasts.