Betting

11/3/22

4 min read

NFL Betting is Getting Even Harder, But Why?

The NFL betting market is widely considered to be one of the most efficient in the world.

Information has become more easily accessible, enabling handicappers to analyze games over the course of a long week before placing a wager. This allows the markets to take shape over a longer span relative to other sports as more information and opinions become known.

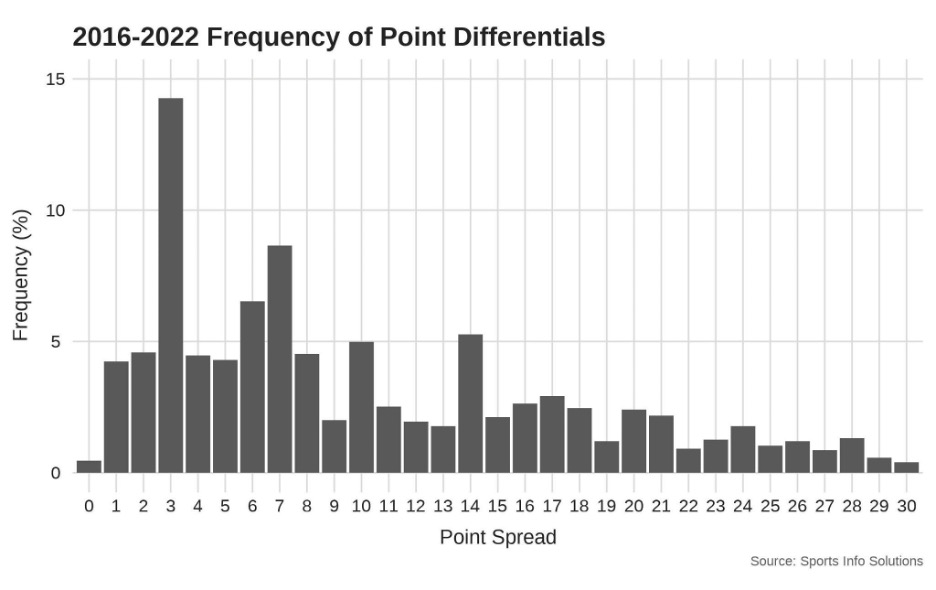

NFL point spreads are considered to be the most popular markets to bet into, and thus, the most difficult to gain a profit. Obtaining closing line value is almost required to end up in the black over a long period of time, and is even better when getting a number that closes on the other side of three and seven. Since 2016, these two “key” numbers have landed as the point differential 14% and 9% of the time, respectively, making them the two highest in frequency. With the difficult nature of gaining value around the key numbers and winning on point spread bets, the “Wong teaser” has gained in both popularity and profitability.

A Wong teaser leg is taking a favorite of -7.5 or -8.5 down to -1.5 or -2.5 or an underdog of +1.5 or +2.5 up to +7.5 or +8.5. In both cases, either leg type crosses the key numbers of three and seven. Typically, one would pair two legs (two different teams) together to pay a price around -120 for a two-team Wong teaser, which means that the break-even percentage for one leg needs to be 73.8% for that price to be fair.

From 2016 to 2021, Wong teaser legs covered at 78% based on the closing spreads, meaning that a fair price for a two-team Wong teaser is -155. This explains why books have increased their price from -110 originally and now even higher than -120. Data has shown Wong teasers have been very profitable for bettors and were being underpriced.

An additional breakdown below shows how each leg does by home and road, favorite and underdog, and the combinations of them both over the five-year span. Road teams during this time span were extremely profitable (which might not be surprising as home field advantage has declined in recent seasons).

2016-2021 Team Type Wong Teaser Cover Percentages

| Type | Cover Percentage |

| Home Team | 74% |

| Road Team | 83% |

| Favorites | 77% |

| Underdogs | 78% |

A combination analysis of these conditions shows that both road favorites and road underdogs are more profitable than their home team counterparts.

2016-2021 Combination Team Type Wong Teaser Cover Percentages

| Team Types | Cover Percentage |

| Home Favorites | 74% |

| Road Favorites | 85% |

| Home Underdogs | 73% |

| Road Underdogs | 82% |

Thus far in 2022, we’ve seen a correction back to reality for all of those who had reaped in the benefits from Wong teasers over the last five seasons. Through Week 8, these legs have only covered 48% of the time, by far the lowest of the last six years through this point in the season. Additionally, both home and road favorites have struggled mightily, with a road favorite having yet to cover a Wong teaser leg.

What could be the reason behind the decline in Wong teaser success? For starters, the amount of Wong teaser leg opportunities is down this year through Week 8. In an effort by the sportsbooks to limit action on a profitable proposition for bettors, books are starting to shade point spreads off of the traditional Wong teaser numbers. With less opportunity, an increase in variance has crept in for the worse in the success of these wagers.

Number of Wong Teaser Leg Opportunities Through Week 8

| Season | Number of Wong Teaser Legs |

| 2016 | 36 |

| 2017 | 28 |

| 2018 | 32 |

| 2019 | 19 |

| 2020 | 25 |

| 2021 | 32 |

| 2022 | 23 |

Also, underdogs as a whole are winning outright at 39%, the highest rate since 2016 through Week 8. Even more eye-popping, underdogs of seven points or more are winning at a whopping 31% through Week 8, by far the highest in the last six years. Losing outright certainly does not get the favorite-legs to the window, and that has happened at an extremely high rate this year.

Historically profitable, Wong teasers have taken a step back and are taking back some of the profits previously handed out. As the season wears on, it will be worth monitoring if market correction takes place on teams that were not expected to compete and if the books will continue to shade lines around teaser numbers.

Prepared by Sports Info Solutions' James Weaver

WATCH MORE: GMs Feeling Inclined to Win Now With Increased Volatility of Job