Analysis

12/23/21

17 min read

Sports Betting is Expected to Cause NFL Revenues to Soar

Last week, at their December meeting in Dallas, the NFL owners awarded the 2024 Super Bowl to Las Vegas. The announcement drew little fanfare outside the city limits of the neon-lit Nevada town. The NFL typically likes to use their February showcase game to show off glitzy new palaces like the Raiders’ two-year-old Allegiant Stadium.

The fact that the Raiders now call Las Vegas home and the fact that the league is going to be holding its marquee event there in just two years, makes it easy to forget that, until very recently, the NFL wanted absolutely nothing to do with the town or its primary revenue-producer, gambling.

For years, the NFL was so opposed to gambling and any link to it that it even banned its broadcast partners from running commercials that promoted Las Vegas as a tourist destination.

It fought every attempt to legalize sports betting with the fierceness of a goal line stand. Back in 2002, when Delaware was considering reinstating and possibly expanding the state sports lottery it had offered in the ‘70s, the NFL teamed up with the other four professional sports leagues and fought it.

They issued a joint statement that said in part, “Sports gambling threatens the character of team sports. Our sports embody our very finest traditions and values. They stand for clean, healthy competition. They stand for teamwork. And they stand for success through preparation and honest effort.

“With legalized sports gambling, our games would instead represent the fast buck, the quick fix, the desire to get something for nothing. Legalized sports gambling would change – for the worse – what our games stand for and the way they are perceived, and magnify the ever-present risks of corruption and scandal.”

The NFL twice took on Delaware in court and did the same against New Jersey.

NFL SHUT DOWN ROMO

As recently as six years ago, the NFL’s attitude toward sports betting, at least publicly, still hadn’t seemed to change one iota. Tony Romo, then near the end of his playing career with the Dallas Cowboys, was scheduled to headline a fantasy football convention at the Venetian Resort Hotel Casino in Las Vegas. He and about 60 other players were going to sign autographs and schmooze with the attendees. Harmless, right?

The event was going to be held in a ballroom at the Venetian, which was separate from, but near its sportsbook property. That was enough to prompt league officials to launch a missile strike. They informed Romo and the rest of the players that they would be fined and/or suspended if they appeared at the event. The players had to back out and the event was promptly canceled.

“It’s amazing how quickly things have changed,” said longtime NFL executive Joe Banner. “The league went from you can’t set foot in a casino to moving the Raiders to Las Vegas to now, giving the city a Super Bowl.

“I’m not saying it’s wrong. But it’s obviously a very dramatic switch in a very short period of time.”

Indeed it is. And it’s only a very small part of the stunning 180-degree turnaround by the NFL and the other major professional sports leagues toward sports gambling.

The Church Lady has gone into business with Satan.

The major impetus for the enemies-to-business partners switch has been the May 2018 ruling by the U.S. Supreme Court which overturned the 26-year-old Professional and Amateur Sports Protection Act (PASPA), which prohibited all but a handful of states from having any kind of legalized sports betting.

Now that sports gambling has become legit, the NFL and the other sports leagues, have abandoned the moral high ground they had long held on gambling and are exploring every possible opportunity to make as much money as possible from America’s fascination with sports betting.

In April, the NFL announced its first-ever sportsbook partnerships with Caesars Entertainment, DraftKings and FanDuel. In August, the league announced agreements with four more sportsbooks – FOXBet, BetMGM, PointsBet and WynnBET to become approved sportsbook operators for the 2021 season. In late July, the New Orleans Saints signed a stadium naming rights deal with Caesars that could be worth as much as $12 million a year to the team.

The league also has a deal with software company Betgenius, which distributes its statistical data to the sportsbooks. Many NFL teams already have opened betting lounges in their stadiums, though they are basically just high-end sports bars at this point.

And this likely is just the beginning. People in both the NFL and the gambling industry say it’s only a matter of time before the league sells the streaming rights to games to some of their sportsbook partners so that bettors can watch the games and wager simultaneously on the sportsbook’s website.

BIG MONEY TO BE MADE

But the huge difference-making money that NFL teams are eyeing in the not-too-distant future will come from obtaining their own in-person and online sports book licenses, which would enable them to pocket a huge chunk of the in-stadium wagering during games.

“A team that has the right to control an online sports-betting site essentially would have a license to print money,” said Daniel Wallach, a gaming attorney and sports betting legal expert.

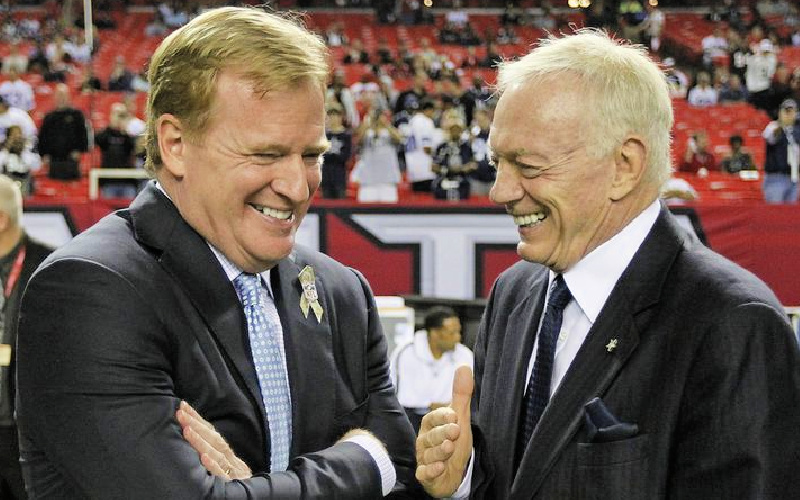

“That wouldn’t be an insignificant revenue stream. If it’s in a market as big as Texas, (Cowboys owner) Jerry Jones could be sitting on a $100 million-plus annual annuity just from operating the in-person sportsbook and the online sportsbook and who knows what else. I mean some teams could end up building casinos next to their stadiums as well.”

“If they’re aggressive about it, and they seem to be moving into an aggressive mode, we’re all assuming it’s going to create a significant new pool of revenue,” said Banner. “You never know that for sure, but my expectation is that it’s going to be quite lucrative.”

For the moment, the NFL is taking baby steps. But even those are going to result in significant revenue gains for a league whose goal, even before gambling arrived on the scene, was to reach $25 billion in revenues by 2027. With gambling, that would seem to be a slam dunk.

“The most profitable arm of this [partnership] right now is the advertising revenue,” said Captain Jack Andrews, a professional bettor and co-founder of the popular betting website unabated.com. “I think that’s what the NFL is banking on the most.

“The networks take in the advertising money. But this raises the value of the networks’ (broadcast) fee because the league knows that the networks have these high-paying ad-revenue customers. The league will benefit by being able to raise the rights fees.”

The seven sportsbooks are spending tens of millions of dollars on advertising as they try to put a Disney-like face on an industry that, for the longest time, was considered street-corner sleazy.

CHANGING IMAGE OF SPORTS GAMBLING

Caesars is using the Manning family, actress Halle Berry and actor-comedian J.B. Smoove in its commercials. PointsBet has hired Drew Brees as its main pitchman. I mean, if Drew Brees is selling it to us, it must be wholesome, right?

“It’s getting to the point where [sports gambling] is being considered beyond reproach,” said former New York Jets and Miami Dolphins general manager Mike Tannenbaum. “The historical view of gambling isn’t good. But they’re working hard to change their image, and they seem to be succeeding.”

The public perception of sports gambling has been changing for a while now. Daily fantasy sports has played a big role in that.

“The true catalyst, if you really think about it, was the emergence of daily fantasy sports, which became fairly widespread in 2014-15,” Wallach said.

“The emergence of DFS and the rise of casino gambling nationwide created a more favorable public perception around wagering on sports. This is not 1991 anymore where you had two states with casinos and absolutely no fantasy sports.”

How popular has sports gambling become? Well, last month, New Jersey became the first state to produce more than $100 million in sports-betting revenue in a single month off of nearly $1.3 billion in wagering, according to PlayNJ.com. Since the sports-betting market opened in June of 2018 after PASPA was overturned, New Jersey sportsbooks have taken in $20.9 billion in wagers, which has yielded $1.55 billion in revenue.

“The sportsbooks want to get their brand out there and convince you that sports-betting is fun,” Andrews said. “But sports-betting also is risk behavior. There’s good bets and there’s bad bets.

“A lot of time, what’s encouraged in the media is largely a lottery mentality. Get rich quick stuff. Let’s put together a 10-team parlay. Put up 50 bucks and win $50,000. That’s the sort of unrealistic expectations that are going to lead a lot of people into the wrong approach to sports-betting.”

The NFL is covering its butt by having its broadcast partners occasionally interrupt the endless stream of Manning family gatherings during games with public service ads featuring the NFL Network’s Steve Mariucci.

The ads are part of a $6.2 million partnership between the league and the National Council on Problem Gambling. They have a clever football-related message: stick with the gameplan. Bet responsibly.

“They’re largely for show,” Andrews said. “But maybe they’ll help somebody.”

It should be pointed out that the NFL owners aren’t the only ones who are going to be profiting from the league’s foray into sports-gambling. So are the players. The collective bargaining agreement the owners and players negotiated last year includes a split of all sports-betting revenue.

“SEMINAL MOMENT”

NBA commissioner Adam Silver could see the sports-betting writing on the wall long before SCOTUS struck down PASPA in 2018. Four years before that, in an op-ed piece in the New York Times, Silver wrote that it was time to legalize – and regulate – sports betting.

“Times have changed since PASPA was enacted,” he wrote. “Gambling has increasingly become a popular and accepted form of entertainment in the United States. Most states offer lotteries. Over half of them have legal casinos. Three have approved some form of internet gambling with others poised to follow.

“There is an obvious appetite among sports fans for a safe and legal way to wager on professional sporting events. Outside the U.S., sports betting and other forms of gambling are popular, widely legal and subject to regulation. In England for example, a sports bet can be placed on a smartphone, at a stadium kiosk or even using a television remote control.

“In light of these domestic and global trends, the laws on sports betting should be changed. Congress should adopt a federal framework that allows states to authorize betting on professional sports, subject to strict regulatory requirements and technological safeguards.

“I believe that sports betting should be brought out of the underground and into the sunlight where it can be appropriately monitored and regulated.”

Tannenbaum said history will look back on Silver’s op-ed as the “seminal moment in the change in attitude [towards sports betting].”

While that may be true, what Silver lobbied for – regulated sports betting – never materialized.

“He was calling for a unified federal framework rather than a patchwork of different states,” Wallach said. “He wanted it to be fully transparent and regulated and monitored. His preference was to have the same approach across the country rather than individual states regulating it in different ways, which is what we’ve got.”

Thirty-three states and counting currently have legalized sports betting. But not all of them have laws in place yet.

“There’s a gap between the legislative enactment of the wagering law and the regulation that comes afterward to help implement the industry,”Wallach said. “Depending on the state, it could be anywhere from a couple of months to upwards of one year to fully implement legalized sports wagering because of the licensing process that is required.”

PLANNING FOR THE INEVITABLE

Publicly, the NFL remained anti-sports gambling right up to the moment SCOTUS struck down PASPA. Privately, they prepared for the inevitable. People like Jerry Jones and Robert Kraft didn’t become billionaires by not having a plan in place to maximize every revenue opportunity in the event the wind shifts.

“By 2017, constitutional scholars were saying that if this ever gets to the Supreme Court (SCOTUS accepted the case in June of 2017 and heard oral arguments in December of that year), there’s a very high likelihood that PASPA was going to get overturned,” Wallach said.

“It was at that point that the NFL started changing its tune, privately if not publicly. It said, you know what, if this happens, we need to be a stakeholder. We need to have skin in the game.

“That’s when you started to see integrity fees and they started mentioning that they have official league data, and the sportsbooks should have to pay for that data. They lobbied hard for the early states to include a tax that went straight to the NFL and insured them of a cut in the handle, in the gross amount of wagers.

“Ever since, they’ve had their hands in the cookie jar.”

The NFL knew that the other sports leagues, particularly Silver and the NBA, were going to jump headfirst into the sports betting arena once PASPA was overturned.

They were not about to risk their standing as America’s most popular – and profitable –sports league by being unprepared for that moment.

“You don’t want the NBA to become more popular or even close the gap with you because they’re engaged in gambling and people are enjoying that and you decided not to do it,” Banner said. “So, in terms of staying No. 1 on the list of sports leagues, and for pure profitability, it took the choice out of their hands. They had to do it.”

EUROPEAN SOCCER IS THE BLUEPRINT

The big question now is, how much money is there to be made for the NFL in sports gambling? And what’s going to be the best way to maximize that?

Tannenbaum suggested looking across the pond at soccer in the UK and Europe. “Barring some unforeseen event, what’s happening over there, you’re going to see much of the same thing here,” he said.

That would include, at some point, the NFL selling streaming rights to their games to their sportsbook partners so bettors could watch the games on their mobile devices and bet at the same time.

“Sportsbooks in Europe stream the games on the sports-betting platform,” Andrews said. “In other words, you can watch the game on your phone and one-third of your phone is an interactive betting menu so you can watch the game and bet on the game while you’re watching it without taking your eyes away from the screen.

“Sportsbooks would love that. There’s a much higher engagement. It could be a real game-changer in how Americans take in sports. Because these streaming rights will sell.”

What NFL teams really have their eye on, though, what is going to send their revenues soaring to a level they never could have envisioned 20 years ago, is if teams run their own sportsbooks.

“Even if teams aren’t involved directly in having on-site or online sportsbooks, they still stand to make a decent amount of money from all of the commercial opportunities that the league is pursuing,” Wallach said.

“But more recently, the trend has started to shift to teams getting in on the action, so to speak, by lobbying their state legislatures for the right to have sportsbooks at the arenas and stadiums, as well as the right to control an online sports betting line. Teams are looking to put themselves almost in the same position as the gaming operators by monetizing and controlling the sports wager. If you’re going to have an in-person sportsbook and an online sportsbook, revenue opportunities for teams will be significant.”

Wallach said it’s not inconceivable that an NFL team’s control of an online and in-person sports wagering license could generate in excess of $50 million a year.

Three states – Arizona, Illinois and Maryland – already allow sports teams to have licenses to operate their own online sports betting operations. But many others are expected to soon follow suit.

“In Arizona, the Cardinals are going to have a sports betting license,” Wallach said. “Two years from now, I expect both the Cowboys and Texans will have them. That’s the next frontier in the burgeoning partnership between the NFL and sports betting.

“In the early stage of the rollout, it’s been all about sponsorships and data deals. Now, moving forward, it also will fold into potential sportsbook deals at the stadiums and over the internet, with the teams having control or licensing authority.”

Wallach said state legislatures around the country seem receptive to the whole idea. They view an online sports-betting license for a team as another form of a public subsidy.

“But rather than taxes being increased or the public shouldering the burden, this is a private business opportunity being granted to sports teams by the state,” he said.

Wallach said there are states where this won’t happen, including New Jersey, where the state’s constitution allows sportsbook licenses to be granted to only casinos and racetracks. So, while online betting is permitted in Giants stadium, the revenue goes to the sportsbook operator and the online partner, not to the Giants or Jets.

DEALING WITH POTENTIAL ECONOMIC DISPARITY

If some teams are able to have sportsbook licenses and others aren’t, that’s going to create a problem for the NFL: economic disparities between teams in a league whose guiding economic principle has long been revenue-sharing.

“The league would be very concerned about something that half the teams could take advantage of and half couldn’t,” Banner said. “I’m sure it’s something they’ve discussed already. My sense is they definitely would figure out some rule to deal with the situation. It could be an additional revenue-sharing pool. It could be some kind of tax.

“But I would be shocked if they let some teams make all of this extra money if others can’t. That would be very out of sync with the history of the NFL.”

In the nineties, at the height of the Cowboys’ popularity, Jerry Jones challenged the league’s revenue-sharing rules regarding team merchandise. The Cowboys were the league leaders in merchandise sales at the time. Jerry rightly felt it was absurd that his team and a team like the Cincinnati Bengals, who were selling a fraction of the amount of merchandise his team was, were getting the same revenue cut from the league’s licensing arm, NFL Properties.

He made serious noise about suing the league. The league eventually relented, allowing the Cowboys to opt out of the 1/32 split and basically run their own merchandising business.

The league also now allows teams to cut their own marketing deals and maximize those without sharing the revenue with the other 31 teams. But almost everything else, including the ticket sales and broadcast rights fees, are divided 32 ways.

But the money from jerseys and marketing deals is small potatoes compared to the potential revenue involved in sportsbook licenses.

“I don’t think (the licensing agreement with the Cowboys) created a template that they could apply to this situation,” Banner said. “In baseball, they might just look the other way and just say, ‘OK, this is the way we operate. We’re in a capitalist world and each team can do what it wants.

“That will not be what the NFL does. They’ll come up with some rule to at least minimize the disparity in revenue that this would create.”